Problem Statement

Companies operating in various jurisdictions are facing increasing pressure to comply with stringent ESG (Environmental, Social, and Governance) and CSR (Corporate Social Responsibility) regulations imposed by EU and US governance, and various global initiatives.

These regulations are constantly evolving, presenting challenges and significant costs for businesses striving to keep up with the latest requirements. Meanwhile, both governments and markets demand comprehensive, accurate, and timely reporting on a broad spectrum of sustainability metrics.

Despite the growing market for ESG and CSR reporting tools, there remains a significant gap in affordable and reliable AI-powered reporting solutions. This shortfall impedes many Chief Compliance and Sustainability Officers from effectively addressing the scope and meeting the regulatory deadlines. Often it results in hiring more ESG Controllers and Analysts, who require onboarding and managing, and get busy with manual and repetitive tasks.

Cost of neglecting ESG

Financial Risk

76% of consumer say they would cease doing business with a company that neglected ESG principles (PwC Consumer Intelligence Series June 2, 2021). ESG scandals are often associated with reputation damages, leading to slumps in stock prices (Gao et al., 2022; Nirino et al., 2021; Walsh et al., 2009).

Compliance Risk. Under EU rules, companies would fail to verified green claims could be fined up to 4% of annual turnover

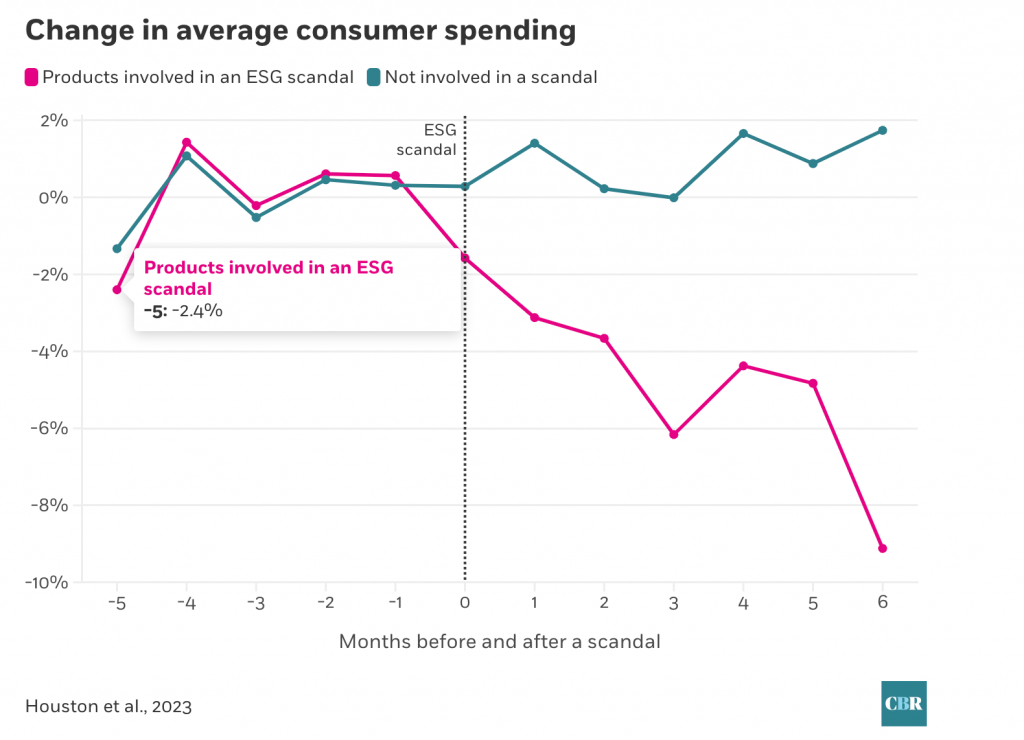

Reputation Risk. Negative news turns customers off: sales of their products fell immediately and continued to decline six months after the incident (Chicago Booth Review, 2023)

Operational Risk. A strong ESG approach can reduce operating costs by as much as 60%. Supply shortages and rolling blackouts, mean that even a small reduction in operating costs can have overarching impacts (Salas Obrien, Adopting ESG: what it is, its drivers and how to take action, 2023)

ESG Value Drivers

There is overwhelming evidence that better ESG performance corresponds with a reduction in downside risk, lower loan and credit and better operational and financial performance.

- Companies that place importance on ESG factors have seen profits rise 9.1% and revenues grow 9.7% (Capital Monitor, 2022)

- Strength in ESG can help reduce companies’ risk of adverse government action, which typically put one-third of corporate profits at risk (McKinsey Quarterly, 2019).

- ESG performance can translate to about 10% lower cost of capital (MSCI, ESG and the cost of Capital, 2020).

- A strong ESG approach can reduce operating costs by as much as 60% (McKinsey Quarterly, 2019)

- Customers willing to pay 9.7% sustainability premium, even as cost-of-living and inflationary concerns weigh (PwC 2024 voice of the consumer survey)

ESG CoRE

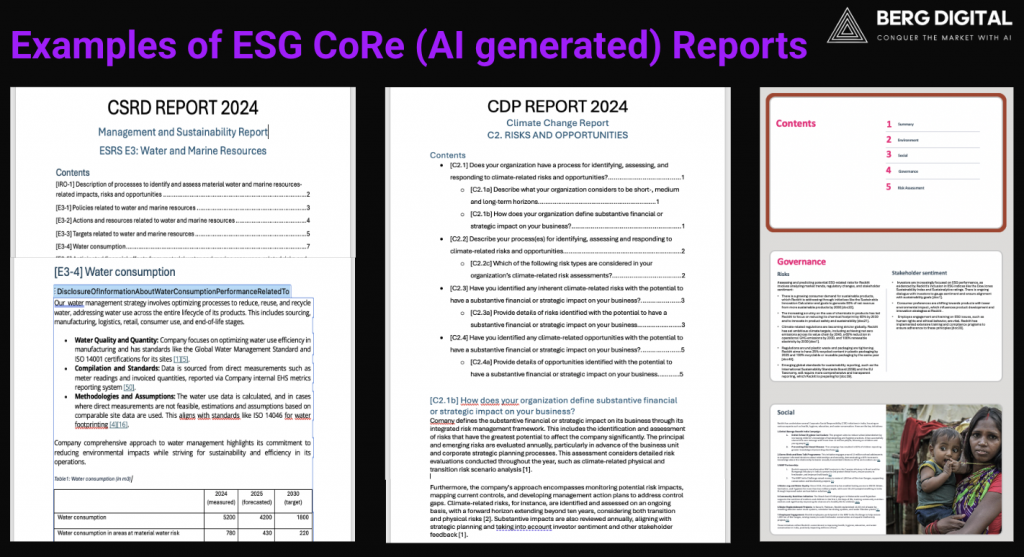

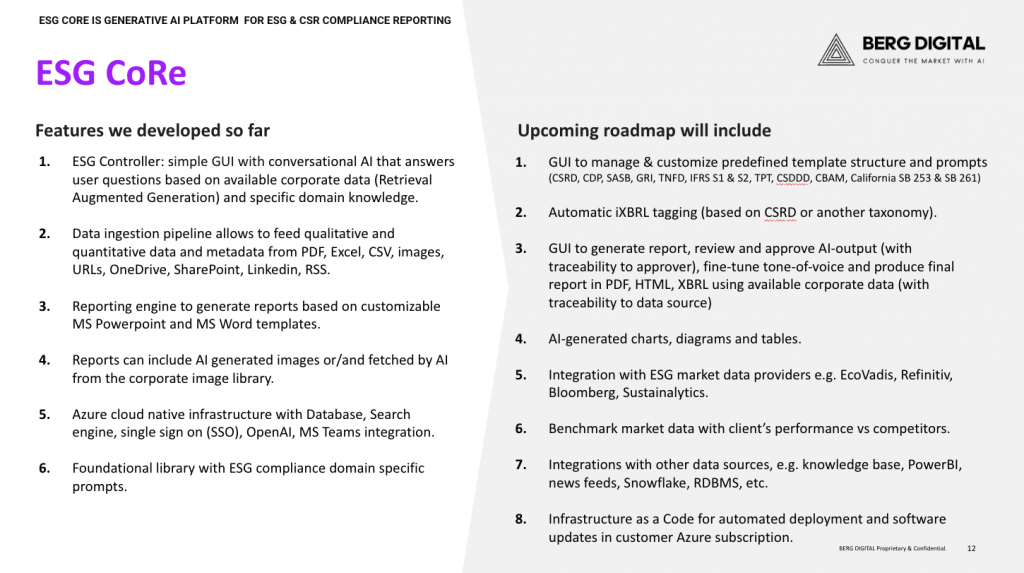

ESG CoRe is a Generative AI-powered reporting engine that provides comprehensive ESG and CSR reports based on predefined and user-uploaded templates, ensuring compliance with regulatory requirements.

The solution automatically ingests and processes quantitative and qualitative data from internal and external sources, and produces coherent, high-quality and traceable output, such as executive summaries, detailed analysis of data points, risk assessments, governance policies as well as images and visualizations.

The solution is deployed to client–managed Azure cloud environment where it can be customized according to corporate ESG framework and approach, including corporate branding and tone of voice.

Out of the Box capabilities

Conversational AI that accesses corporate and industry ESG/CSR knowledge and regulatory requirements to support ESG Controller and Sustainability & Compliance officers in daily tasks. Generation of template-based reports with narrative and visuals obtained from your media library, social networks, knowledge base, newsfeed and other connected sources, and XBRL tagging.

Tailoring solution to Customer needs

We will integrate this tool into your ecosystem, connecting it with internal and external data sources and adopting to your unique tone of voice. Our ESG Consultants, Prompt Engineers and Data Analysts will work with client SMEs to fine-tune prompts and templates for generating wide list of compliance reports (CSRD, CDP, SASB, GRI, TNFD, IFRS S1 & S2, TPT, CSDDD, CBAM, California SB 253 & SB 261).

Under the Hood

The AI responses are crafted through custom prompts written by our ESG experts who have worked extensively with LLMs, ESG frameworks and datasets, regulatory documents and compliance requirements . Our cloud-native solution currently utilizes Azure AI Search and Azure OpenAI services with most advanced foundation models.

Business Benefits

ESG CoRe is the cornerstone of a modern ESG and CSR reporting experience based on cutting-edge AI technology. It was designed to provide a seamless experience for faster, accurate and traceable-to-the-source reporting.

Reduced Manual Work. Report generation based on pre-define prompts and template reduces time spend to mine relevant data, analyze it and compose document with digital tagging manually.

Quicker Iterations of Reviews. GenAI engine allows to build next version of report within minutes after most recent data or feedback from previous iteration were made available.

Higher Employee Satisfaction & Retention. By automating repetitive and long processes, ESG and CSR analysts can shift their focus from composing reports to more value-added tasks, leading to increased productivity and job satisfaction.

Better quality and accuracy. All output is based on original data being referenced. End-user tweaking and improvement suggestions could be fed back into the model to continuously improve accuracy.

10 reasons why opt for ESG CoRe

- Built on Microsoft Azure, enterprise cloud platform scalable to accommodate growing data volumes and user needs, solution provides robust security features and compliance certifications to protect sensitive ESG data.

- Your data remains yours, no exceptions: unlike SaaS tools that store and may (re)use uploaded customer data, ESG CoRe operates within the organization perimeter, and never shares nor uses customer data for model training or analytical purposes.

- You are in the driver’s seat: while our solution includes pre-built report templates (CSRD/CDP) and dozens of pre-defined prompts, you can tailor them to meet organizational tone-of-voice, scope, level of details or other requirements, including adherence to industry-specific standards and other reporting frameworks.

- Visual: reports may contain tables, graphs or diagrams, and can be illustrated with AI generated pictures or images from integrated corporate media library.

- Integrated: ESG CoRe can be seamlessly integrated with other Microsoft tools and services, such as Power BI, Teams, Outlook and SharePoint, for efficient collaboration and data visualization.

- Affordable Total Ownership Costs: you pay for integration and support and bear infrastructure and consumption cost. No user-based license fee is charged.

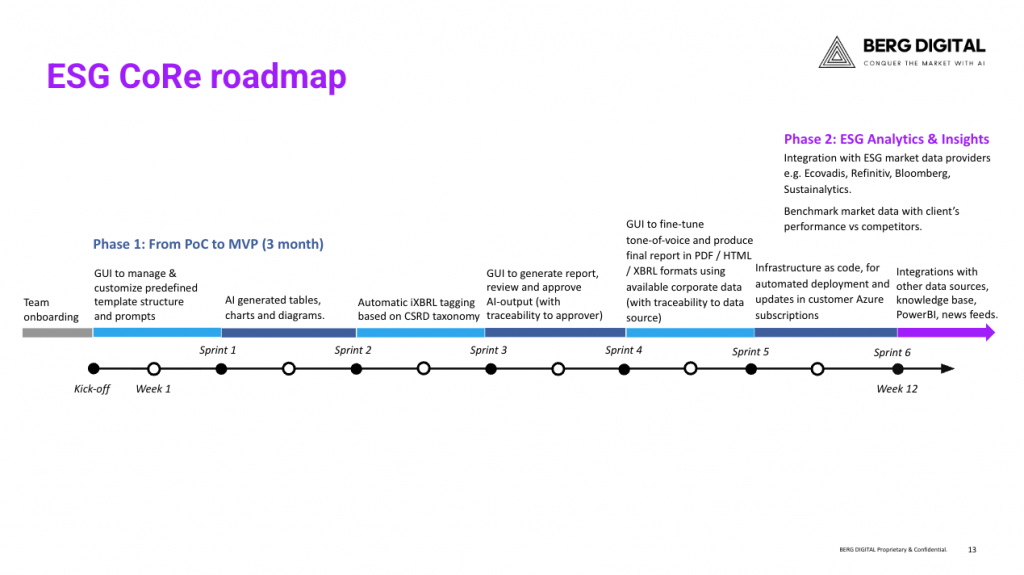

- Lightening fast readiness: it takes only 6+ weeks from project kick-off until first report generated based on your data (for setup where no extensive customization is required), thanks to time-proven deployment blueprints and our delivery methodology. Full-fledged integration into large organization requires, on average 6 months.

- You are not alone: our ESG experts and data analysts are always ready to take care of most challenging tasks related to report preparation to ensure meeting deadlines.

- Customised report types: in addition to supporting leading global reporting frameworks, ESG CoRe solution can generate PowerPoint presentation in almost any languages, ensuring your sustainability communications reach various stakeholders both inside and outside of your organization.

- Professional support: technical support will be provided by our offshore team during your working hours, while ongoing maintenance and upgrades will be delivered outside of working hours per agreement between our IT organizations.